RBI gives NBFCs room to hold on to realty hopes

- 2020-04-20 18:20

- By livemint.com

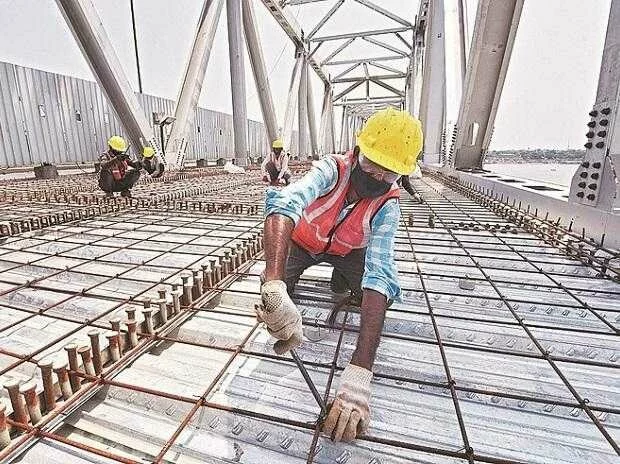

The Reserve Bank of India (RBI) has let non-banking financial companies (NBFCs) extend by a year the date for starting operations for loans to real estate projects delayed for reasons beyond the control of promoters. By December that year, the total deposits of banks were at ₹105.7 trillion, a jump of 6.5% in a span of two months. Before NBFCs became aggressive lenders to the real estate sector, it was funded primarily by banks and people looking to buy under-construction properties, who ended up having to pay upfront for their purchase. As Arvind Subramanian and Josh Felman write in a working paper, India’s Great Slowdown, published in December 2019: “In recent years most of the incremental lending has come from NBFCs, so much so that by 2018-19, NBFCs accounted for about half of the ₹5 lakh crore (trillion) in real estate loans outstanding." As Subramanian and Felman write: “This funding was provided on the assumption that developers would be able to complete their projects, sell off their inventories, and then repay." The inventory of unsold homes of builders continues to run into hundreds of thousands. RBI’s latest move allows real estate builders another year to meet their loan obligations. This helps NBFCs, as the chances of builders defaulting on loans were high given the lack of new home sales. In this scenario, if real estate companies don’t pay up NBFCs, the latter won’t be able to repay banks. On the other hand, the chances of real estate prices crashing just went down a tad.

Only negligent employers to be charged for Covid-19 cases; India Inc upset

Goa to recommend extension of lockdown till April 30

Corona: Bhubaneswar to screen 2 lakh slum dwellers | India News - Times of India