A 6 month financial support scheme for micro enterprises needed to ride through the pandemic

- 2020-04-25 07:05

- By economictimes.indiatimes.com

By Sanjay Sharma The pandemic has now crossed our door and is increasingly spreading in the communities across a large number of districts in India. However, as the lockdown prolongs, the possibility of huge multi-billion dollar financial damage to the economy is very real. If the problem is not managed effectively, there could be a significant part of these micro MSMEs may have to shut shop. If this were to happen, it would bring on an unimaginable calamity that would manifest itself as the large unemployment, suffering and the long-term damage to the Indian economy. This may undo the advances made over a decade in poverty reduction and improved social inclusion. The resilience and survival instinct of micro enterprises now faces a once in a hundred year challenge. Having survived and thrived despite the disruptions like demonetization and GST implementation, we are once again faced with an impossible challenge. What is needed is an accommodation for upto six months, to allow the micro enterprises to tide over the financial turmoil that will ensue at the wake of the pandemic. Secondly, the moratorium on funding to NBFCs should similarly be ensured by their Lenders and Banks, to maintain the transmission of liquidity. Thirdly, the government should make available a special line of aid or soft funding to allow these enterprises and their employees to see the next 6 months through.

Students worry about rent payment in Delhi

Edited Transcript of INFRATEL.NSE earnings conference call or presentation 24-Apr-20 9:00am GMT

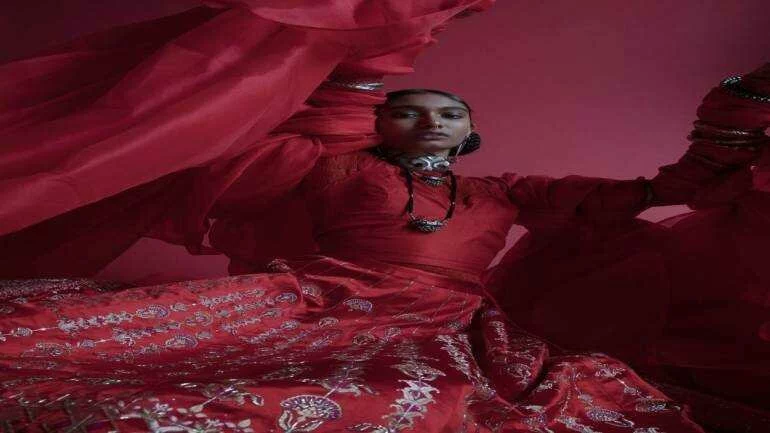

What It Looks Like When India's 1.3 Billion People Stay Home