Calls for India Fiscal Aid Grow Louder as Industry Struggles

- 2020-04-29 05:48

- By finance.yahoo.com

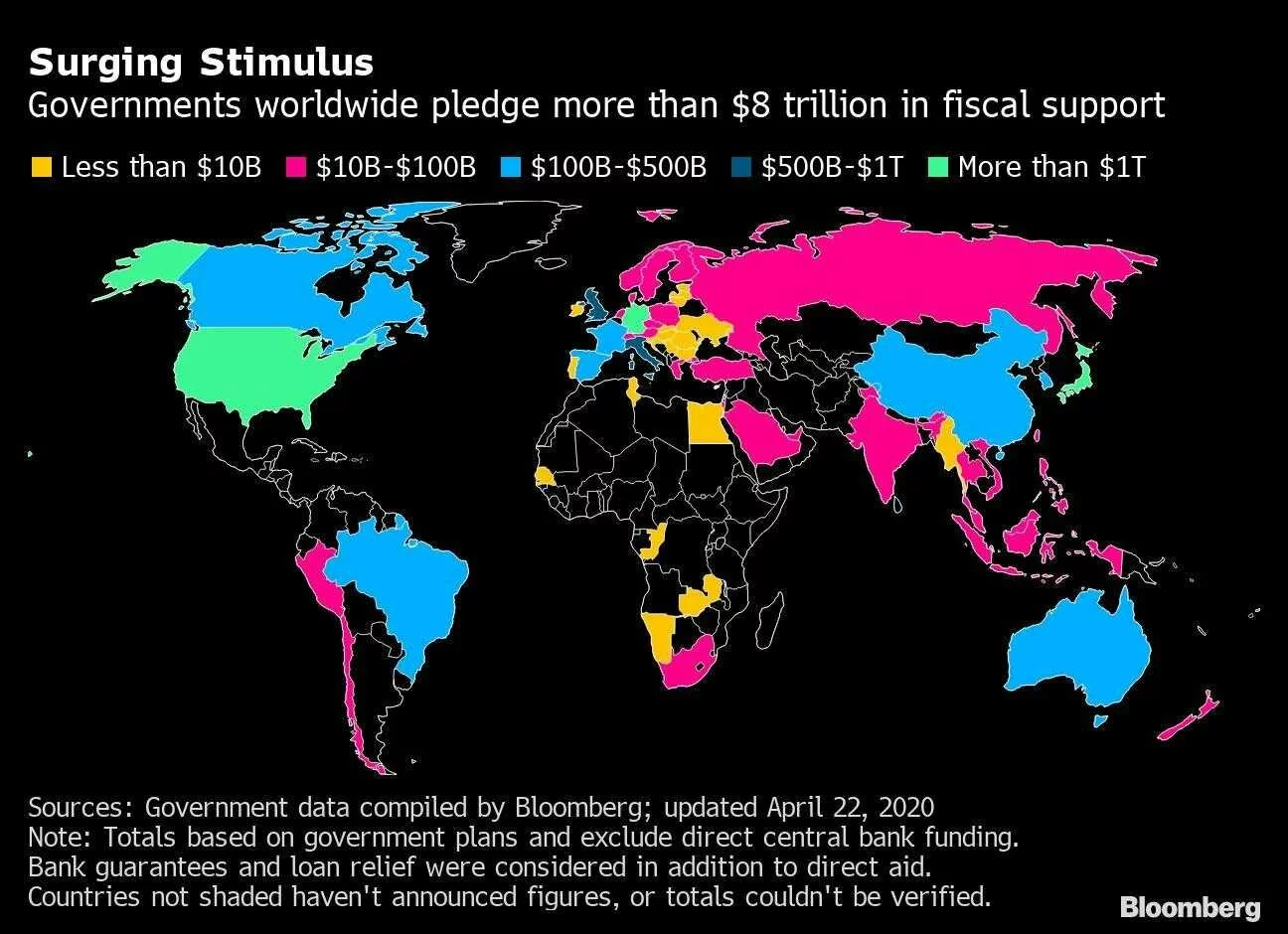

(Bloomberg) -- Prime Minister Narendra Modi’s government isn’t rushing to the aid of businesses in India clamoring for fiscal support as a 40-day lockdown to contain the coronavirus threatens their survival. On March 26, Finance Minister Nirmala Sitharaman announced 1.7 trillion rupees ($22.3 billion) of direct support to the poor to see them through the shutdown period, while promising more steps to shield the economy. From small and mid-sized businesses like Anntech to big brands like Hero MotoCorp Ltd., India’s top motorcycle maker by volume, companies are increasing their calls for aid including loan support, wage subsidies, tax deferrals and a moratorium on utility payments. Businesses like Anntech fall into the category of micro-, small- and medium-sized enterprises, or MSMEs, which account for a third of India’s economy and employ more than 110 million people. “A timely policy intervention to augment their cash situation is essential,” said Sonal Varma, chief economist for India and Asia ex-Japan at Nomura Holdings Inc. in Singapore. Wealthy countries like Germany and Italy have allocated fiscal stimulus, including bank guarantees, of more than 30% of their gross domestic product. The economy is heading for a possible contraction in the current quarter, with an 18% chance of a recession within the next 12 months, according to the median forecast in a Bloomberg survey of 10 economists. Faced with a weakening economy before the virus outbreak, Sitharaman widened the fiscal deficit target for this year to 3.5% of GDP. Rating companies “might take an adverse view of the fiscal push and the consequent debt buildup,” said Indranil Pan, an economist with IDFC First Bank. Global funds withdrew a record $16 billion from local shares and bonds in March and continued to dump the country’s assets this month, making the rupee one of Asia’s worst performing currencies since the beginning of April.

Shahbaz slams Indian atrocities in Held Kashmir

The Pandemic Will Cleave America in Two